Smarter, More Affordable Health Coverage for Industry Professionals

|| The Assurance You Need, When You Need It ||Health Plans designed for Insurance, Financial, and Real Estate Professionals.

Save More on Tailored Coverage

Get access to competitive, cost-effective health plan options designed to keep more money in your pocket.

Guidance from Trusted Experts

Work with knowledgeable advisors who simplify your choices and help you find the right plan—quickly and confidently.

Proven Results

Join thousands who have successfully secured better coverage through our streamlined, high-success enrollment process.

|| About Our Company ||

Affinity Benefits was founded on a simple belief:

Everyone deserves access to sustainable, straightforward health coverage.

We’re a national team of consultants who meet organizations where they are — while our leadership designs benefit programs that deliver real value, not just complexity.

Partnership

We work alongside organizations to build solutions that fit.

Transparency

No hidden complexity. Just clear, simple programs.

Stability

Reliable benefits built to last, year after year.

Accessibilty

Coverage designed for every person and every group of all sizes, nationwide.

Year Of Experience

|| What We Offer ||

Multiple Coverage options to fit your needs.

Affinity Health Program is a Level Funded and Medically Underwritten, ACA Compliant Plan.

Our health program offers comprehensive coverage for individuals and families. Tailored health coverage designed specifically for 1099, owner operator, association members, and small businesses. Offering comprehensive care with $0 preventative, telemedicine, virtual primary care, and access to a nationwide Cigna network.

First Dollar coverage with no additional costs available through Integrated Source One’s Virtual Direct Primary Care for telehealth, Virtual Coordinated Care and Disease Management for Chronic Conditions.

1000 Cigna Plan

Deductible Amount

$1,000 Single

$2,000 Family

Preventative Care

100% Coverage

Max Out-of-Pocket

$5,000 Single

$10,000 Family

1500 Cigna Plan

Deductible Amount

$1,500 Single

$3,000 Family

Preventative Care

100% Coverage

Max Out-of-Pocket

$7,350 Single

$14,700 Family

2500 Cigna Plan

Deductible Amount

$2,500 Single

$5,000 Family

Preventative Care

100% Coverage

Max Out-of-Pocket

$7,350 Single

$14,700 Family

3500 HSA Plan

Deductible Amount

$3,500 Single

$7,000 Family

Preventative Care

100% Coverage

Max Out-of-Pocket

$6,550 Single

$13,100 Family

5000 HSA Plan

Deductible Amount

$5,000 Single

$10,000 Family

Preventative Care

100% Coverage

Max Out-of-Pocket

$6,550 Single

$13,100 Family

7350 Cigna Plan

Deductible Amount

$5,000 Single

$10,000 Family

Preventative Care

100% Coverage

Max Out-of-Pocket

$6,550 Single

$13,100 Family

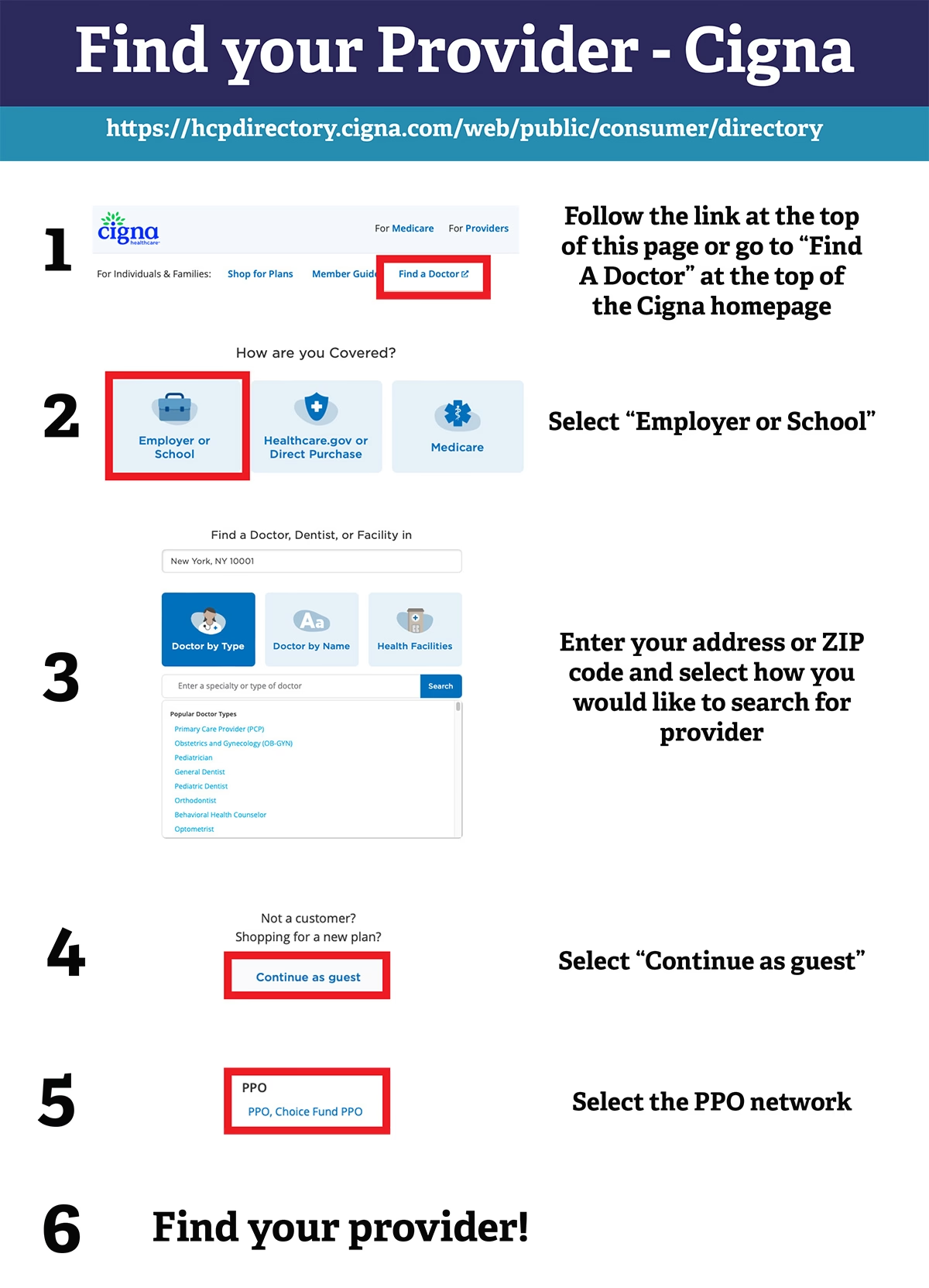

Find An In-Network Provider

Search for a doctor who is taking new patients.

Then come back here to start your application!

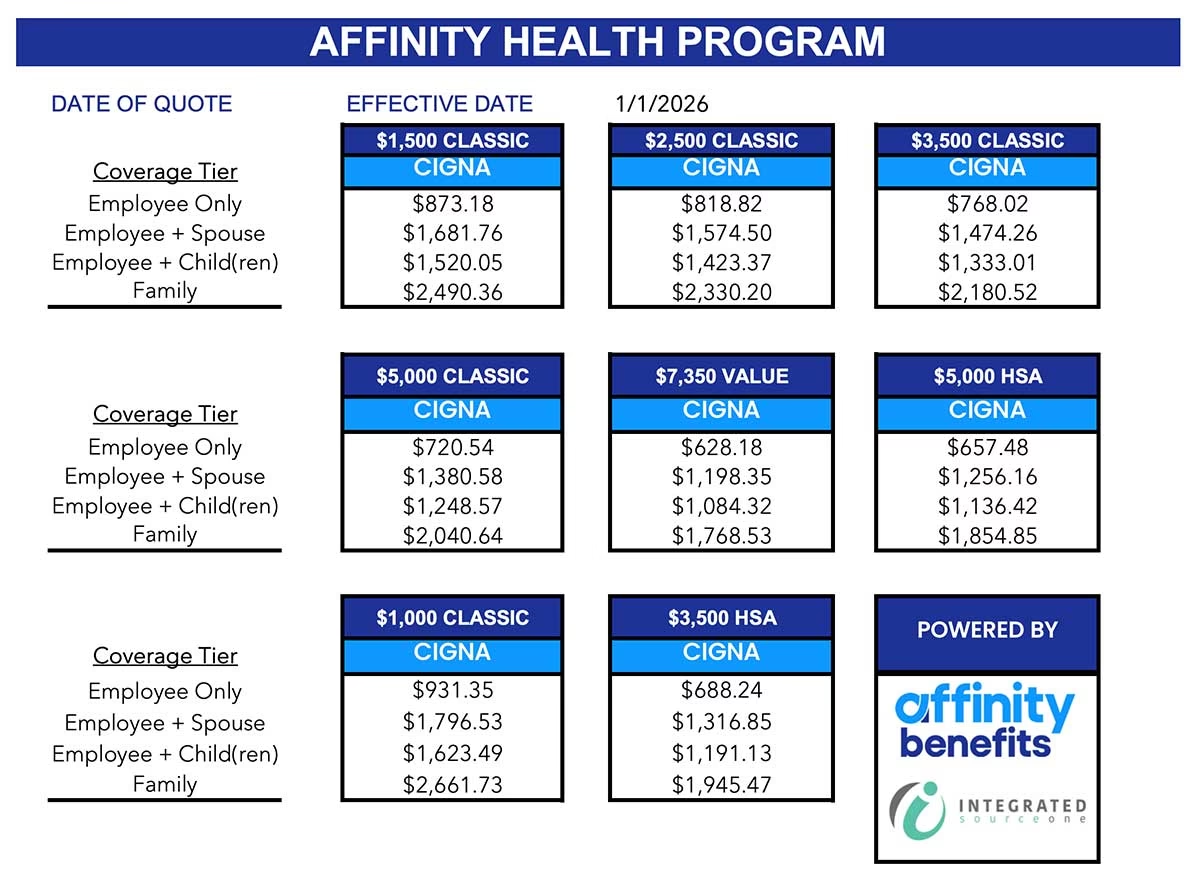

Our Pricing Plans

Compare the Rates

Virtual Patient Care is INCLUDED with every Affinity Health Program Plan

- No copays

- No deductibles

- 24/7 access

- Unlimited visits

- Mental health + urgent care support

Basic Plan

Per Month- Invoices/Estimates

- 20 Workers

- 12 Month Support System

- Limited Servise

- 12 Month Support System

- Plus One-Time HR Audit

Premium Plan

Per Month- Invoices/Estimates

- 20 Workers

- 12 Month Support System

- Limited Servise

- 12 Month Support System

- Plus One-Time HR Audit

Business Plan

Per Month- Invoices/Estimates

- 20 Workers

- 12 Month Support System

- Limited Servise

- 12 Month Support System

- Plus One-Time HR Audit

Not Sure What to choose? CONTACT US for your Custom Package

How do I apply? What is the process?

The Affinity Health Program is set up with all premiums and plan summaries available prior to applying. Once you have filled out the information tab you will be emailed a secure link to fill out the health questionnaire and ACH information. Once approved you will be automatically enrolled! Should you not be approved no deduction will occur. It’s that simple!

For groups larger than 1 once the census is completed, we will securely email all applicants for health questionnaires and once completed provide your organization with a personalized quote.

|| What We Offer ||

We’re Covering All The Insurance Fields

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, nd it by injected humor, or randomized words which don’t look even slightly believable.

Fast and Easy Process

Lorem Ipsum is simply dummy text of the printing.

Protect & Save Money

Lorem Ipsum is simply dummy text of the printing.

Digital Policy System

Lorem Ipsum is simply dummy text of the printing.

Better Family Life

Lorem Ipsum is simply dummy text of the printing.

|| Our Portfolio ||

We Have Lots of Insurance Work Done. Let’s Check Our Case Studies.

See If You Qualify

Filling out this form will start your application process.

Your Experienced Insurance Specialist

Jeanie Cunningham

Sales Consultant

With years of experience guiding clients through the insurance landscape, Jeanie Cunningham combines deep expertise with a personal, no-pressure approach. Her mission is simple: help you save money and feel confident in your coverage.

|| Our Client’s Feedback ||

What People Are Saying About Their Health Coverage with Affinity

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of.

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of.

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of.

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of.

|| Faq & Help ||

Common Frequently Asked Questions

We know insurance can get complicated. Our FAQ covers the most common questions so you can make an informed decision.

What makes the Affinity Health Program different from traditional health insurance?

The Affinity Health Program is designed specifically for professionals in the Insurance, Financial, and Real Estate industries, focusing on cost savings, flexibility, and simplified enrollment. It’s structured to offer high-value coverage options without the overhead or complexity of major medical plans.

Who is eligible to enroll?

Individual professionals in the Insurance, Real Estate, and Financial sectors, as well as small business owners in these industries, may qualify. To confirm eligibility, simply fill out the appropriate contact form on the website.

How much do the plans cost?

Pricing varies depending on the plan selected, individual vs. group enrollment, and coverage needs. A full breakdown is available in the plan PDFs provided on the website.

Are there options for businesses with employees?

Yes. Businesses can enroll under a group-style structure. Until the official association form is available, employers can email Jeane directly or submit the census form provided on the website.

Do I need a medical exam to qualify?

Our plans do not require a full medical exam, but do ask basic health questions and eligibility confirmations. This will be clearly indicated in each plan’s PDF.

How quickly can coverage begin-when is the enrollment period?

Coverage typically begins on the first of the month after enrollment is completed. Certain plans may offer alternative effective dates based on underwriting or association rules. Applications must be completed by the 12th of the month to be eligible for coverage the following month. Example-Complete by December 12th for January 1st coverage.

Enrollment can be any month of the year.

Can these plans be paired with other insurance products?

Yes. Many professionals pair them with supplemental health, life, or disability products.

(If you want, we can add suggestions for complementary products.)

How do I apply? What is the process?

The Affinity Health Program is set up with all premiums and plan summaries available prior to applying. Once you have filled out the information tab you will be emailed a secure link to fill out the health questionnaire and ACH information. Once approved you will be automatically enrolled! Should you not be approved no deduction will occur. It’s that simple!

For groups larger than 1 once the census is completed, we will securely email all applicants for health questionnaires and once completed provide your organization with a personalized quote.

How do I get help choosing the right plan?

Individuals and businesses can submit their information through the contact forms on the site. We’ll follow up personally to review options and make recommendations.

Is my information secure?

Yes. All form submissions are encrypted and handled privately through a HIPPA compliant portal. We do not share information outside of plan administration or enrollment purposes.

How is your offering different from self-funded or fully funded coverage options?

Level-funded health coverage is different from self-funded and fully-funded options mainly in how costs and risks are handled. With level-funded programs, employers pay a set monthly fee that covers expected costs, and any extra money can be saved or used for future expenses. On the other hand, self-funded options mean employers take on the financial risk of providing health benefits, which can cause costs to vary a lot. Fully-funded coverage requires employers to pay premiums to an insurance company, shifting all the risk to them. Level-funded coverage strikes a good balance between managing risk and keeping budgets predictable, making them a popular choice for many businesses.

Why should I choose a level-funded plan for my operation?

Choosing level-funded health coverage for your farm and employees has several benefits compared to self-funded and fully-funded options. First, level-funded options help you stick to a budget by allowing you to pay a fixed monthly fee that covers expected costs. This is important for farms, where income and expenses can vary. Plus, any unused funds can roll over to help cover future healthcare costs or reward your employees.

Level-funded programs also help manage risk. They let you avoid the high financial risks of self-funded options while keeping some control over costs. Unlike fully-funded coverage, where all risks go to an insurance company, level-funded options let you keep some risks and expenses in line with what your farm actually spends. This can save you money over time, making level-funded health coverage a smart choice for your farm and your employees.

Have some Questions?

We’d love to answer!

Still Unsure?We’re here to help you make the right decision on health insurance.

Talk with a real advisor—no pressure, just answers.

Get clear guidance in minutes, not a sales pitch.

Message us with your questionswe’ll help you find the right plan fast.

|| Our News and Blogs ||

Latest Insurance News & Articles From the Blog

Strategy in digital marketing company

There are many and it isvariations of passages of Lorem Ipsum

Automation Nation: Whose Job Is Next?

There are many and it isvariations of passages of Lorem Ipsum

When Sustainability Requires Change

There are many and it isvariations of passages of Lorem Ipsum

Delivering What Consumers Really Value

There are many and it isvariations of passages of Lorem Ipsum